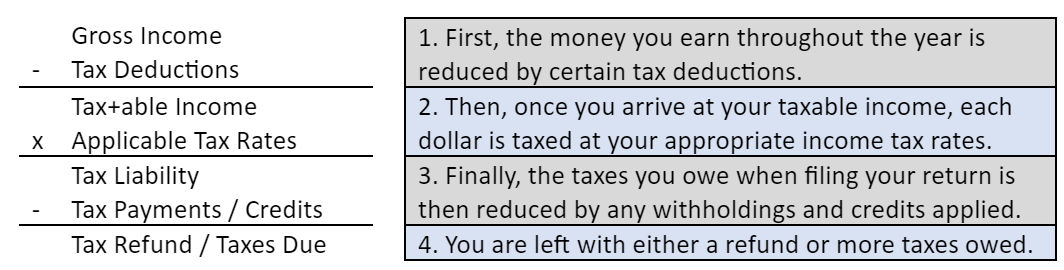

We are back with another addition to our four-part series called, Tax Planning 101. If you remember our last blog, we walked through the how certain adjustments to your gross income are used to calculate your adjustment gross income, and then we took a stroll through both the standard deduction and itemized deductions. In today’s blog we are going to address a very important question that is also the starting point of many income tax planning strategies: “What is my tax bracket?” Before we unpack that question let’s review the basic income tax equation for all U.S. taxpayers:

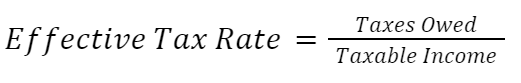

The U.S. individual income tax system is a progressive model, meaning that the more income you earn, the more tax you pay on a pro-rata basis. This is where your tax bracket comes into play, otherwise known as your marginal income tax rate. Your marginal income tax rate is the rate at which each additional dollar of income is taxed. In other words, your taxable income is split into different buckets. As your income grows, each additional dollar that overflows to the next bucket is taxed at that higher rate. For 2023, the federal ordinary income tax rates are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Once you calculate the total income taxes owed, you can then find your effective tax rate – the percent of your taxable income that you pay in taxes, as shown below:

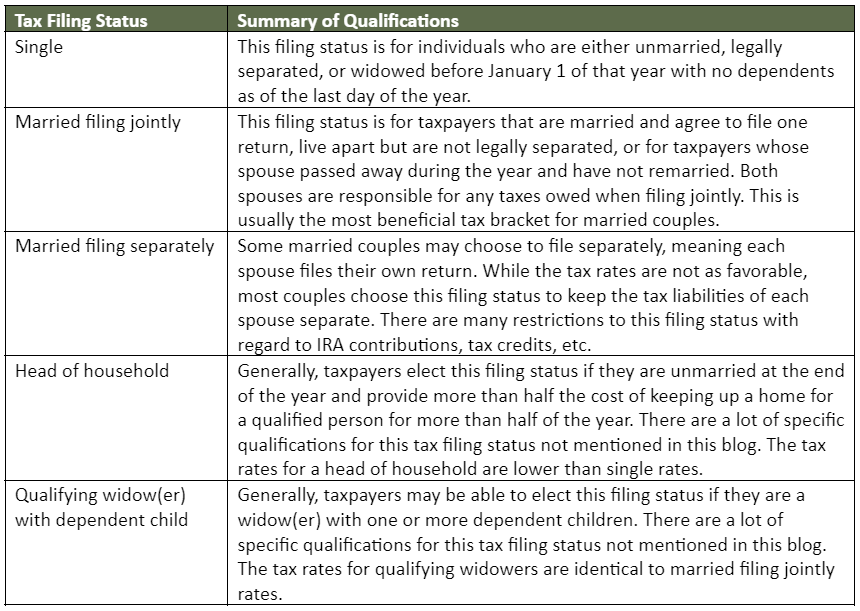

Due to the progressive nature of the U.S. individual income tax code, lower-income taxpayers pay a lower effective (cumulative) tax rate, whereas taxpayers with higher income pay a higher effective tax rate. The tax rates you are subject to depends on your tax filing status. Before we jump into the different tax rates, check out the overview of different tax filing statuses listed below:

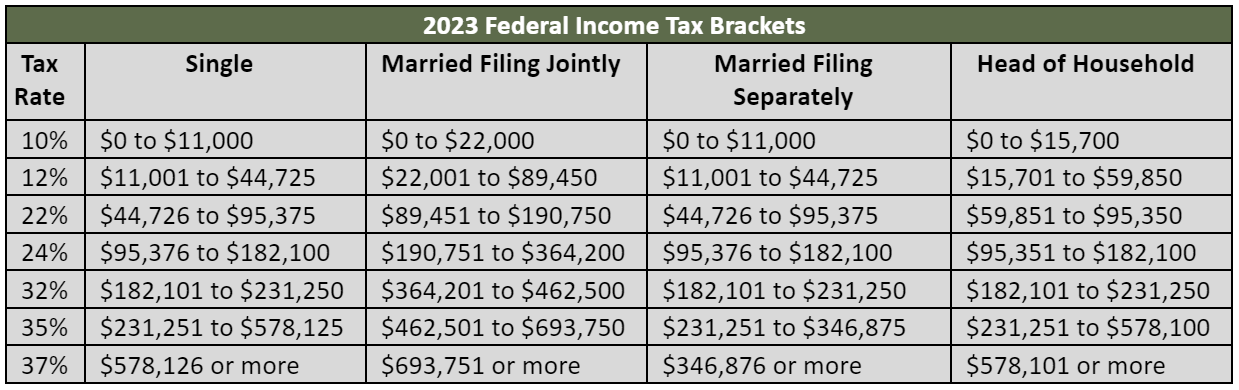

Once your filing status is determined, each additional dollar of income is taxed at the following marginal income tax rates for 2023:

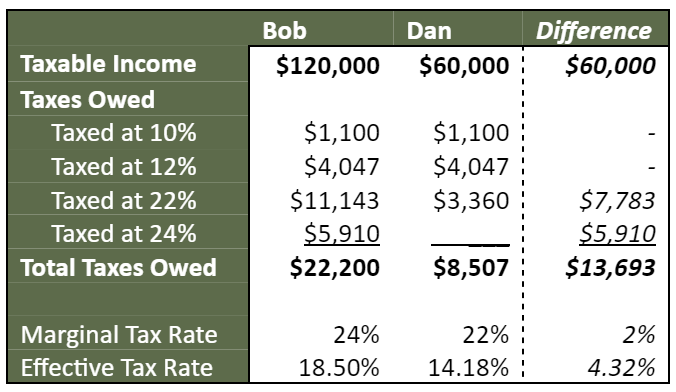

As mentioned earlier, the progressive nature of the U.S. individual income tax code allows lower-income taxpayers to pay a lower effective (cumulative) tax rate, whereas taxpayers with higher income end up paying a higher effective tax rate. To illustrate this point further, let’s look at an example using the 2023 U.S. individual income tax brackets. In the example below, Bob is single and has $120,000 of taxable income for 2023. Dan is single as well but instead has taxable income of $50,000 for 2023. Let’s see how both their marginal tax brackets and their effective tax brackets differ. Note that we are starting at taxable income in this example, meaning that we are ignoring deductions and instead skipping down the income tax equation (refer to the income tax equation at beginning of the blog if needed).

As you can see, Bob and Dan’s income is taxed at the exact same rates for the first $60,000. However, Bob’s additional $60,000 of taxable income is taxed at higher rates, which drastically impacts his effective tax rate. Notice the difference between their effective tax rates – a 4.32% difference and a total of $13,693 more taxes paid by Bob.

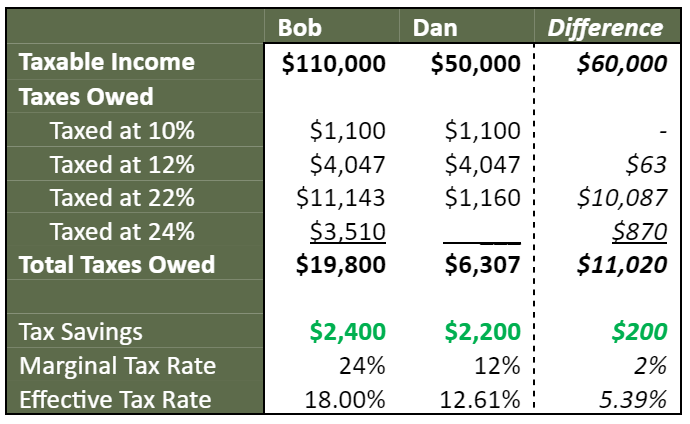

Now, let’s take this example one step further by reverting back to our previous lesson on tax deductions. Let’s say both Bob and Dan contribute $10,000 to their company’s 401(k) plan, thereby reducing their taxable income by $10,000.

As mentioned in our previous blog, that deduction is more valuable to Bob than Dan, due to their differing marginal tax rates. By deferring income into a pre-tax retirement vehicle, both Bob and Dan were able to cut their effective tax rates by 0.50% and 1.57%, respectively. This really shows the benefit of tax deductions, the relationship between marginal and effective tax rates, and the importance of tax planning when utilizing deductions.

We have now walked through filing statuses, tax rates (both marginal and effective), and the impact that deductions can have on your tax bill. Be on the lookout for the next “Income Tax 101” blog, and for those of you that are still with me – tell a loved one what you learned today! Again, take a look at the quiz below to test your knowledge.

- The U.S. individual income tax system is a _________ model

- regressive

- aggressive

- progressive

- excessive

- All of the following are current marginal tax brackets, except:

- 12%

- 32%

- 37%

- 39.6%

- Joe is engaged to Susan. Their wedding date is set for next January. What filing status can Joe elect for tax year 2023?

- Single

- Married Filing Jointly

- Married Filing Separately

- Either b or c

- Your ________ tax rate is the rate at which each additional dollar will be taxed at, whereas your _______ tax rate is a combined tax rate relative to your taxable income.

- Effective; marginal

- Marginal; progressive

- Progressive; marginal

- Marginal; effective

- The U.S. individual income tax code allows lower-income taxpayers to pay a ______ effective tax rate, whereas taxpayers with higher income end up paying a ______ effective tax rate.

- Higher; lower

- Lower; higher

- 22%; 10%

- 10%; 0%

Quiz answers:

- C

- D

- A

- D

- B