Hello again, and welcome to our fourth and final addition to our blog series called, Tax Planning 101. In our last three blogs, we provided a high-level overview of:

- How gross income is adjusted through the use of deductions (click here to read);

- How tax brackets apply to your taxable income (click here to read); and

- How tax credits can be applied directly toward your taxes owed (click here to read).

For our final blog, we equip you with tangible takeaways to answer common questions like: “What is tax planning? How can I apply tax planning strategies to my situation?” To answer those questions, we will provide an overview of tax planning and its benefits, and then we will dive into different tax planning strategies that you should consider.

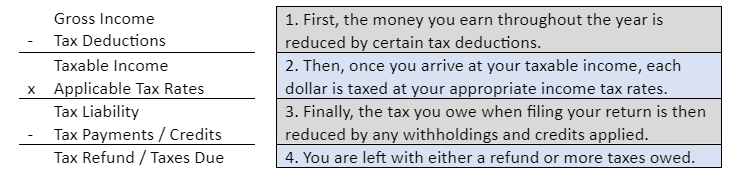

To get started, let’s review the basic income tax equation for all U.S. taxpayers:

There are many ways to implement tax planning into your financial plan. At its core, tax planning involves identifying and implementing strategies to minimize your overall tax liability. These strategies range from utilizing tax deductions and credits to maximizing your tax-equivalent yield within your investments. The following are the most common areas of tax planning:

Retirement Tax Planning

This tax planning strategy focuses on determining the most tax-efficient way to save for retirement. It’s important to first understand what retirement savings tools you have at your disposal. Does your company offer a 401(k) or 403(b) plan? Is there a Roth 401(k) option within your firm’s retirement plan? Once you know what is available, you can determine whether pre-tax or Roth contributions are best and how much you want to set aside each month. From a tax planning perspective, the main goal is to pay the least amount in taxes throughout your lifetime. That said, it may be more advantageous to pay taxes on your retirement contributions now and receive tax-free income later in retirement (Roth). This comes down to determining whether you will be in a higher or lower income tax bracket during retirement.

Once you have reached retirement age, you transition from accumulating to withdrawing from your retirement assets. At this point, you could have a wide range of account types, including 401(k)s, IRAs, Roth IRAs, brokerage accounts, and savings accounts. Determining which account to withdraw from to meet your expenses during retirement can be overwhelming. Throw in Social Security, a pension, and required minimum distributions, and it only makes it more confusing! After spending decades saving for retirement, it’s so important to drawdown your assets in the most tax-efficient way possible. This is where TFG can help plan your Retirement Flight Path.

Roth Conversion

A Roth conversion is another strategy that may be beneficial in the years before taking required minimum distributions. In short, this strategy involves shifting a portion of your pre-tax retirement savings (401(k) plans and IRAs) into a Roth IRA thereby allowing you to pay the tax now while in a lower tax bracket. The amount that is converted grows tax free within the Roth IRA and qualified distributions are also free of tax. If used correctly, a Roth conversion can save you from paying substantial taxes over time. However, it is important to work with an experienced financial planner or tax professional to determine the appropriate amount to convert.

Charitable Contributions

Giving to charity is something that can have a massive impact on your community and the causes that you support. The government has incentivized this type of giving by allowing for a tax deduction if directed toward a qualified 501(c)(3) organization. In most cases, the tax benefit from giving to charity is only awarded for those who itemize their deductions. The Tax Cuts and Jobs Act of 2017 doubled the standard deduction which caused most people that previously itemized to take the standard deduction. As a result, most people are unable to utilize the tax deductions on their charitable contributions. That said, it’s important to check your itemized deductions to determine your current situation.

If you are unable to itemize, one potential strategy that has recently gained popularity is called charitable bunching. This strategy involves “bunching” more than one year’s worth of charitable gifts into one year to itemize deductions. You may be thinking, “I can’t just give three years’ worth of tithing to my church and then not give at all over the next two years.” That’s where the donor-advised fund comes into play. This type of account allows you to take a deduction when funds are transferred into it, and then give from the account to any 501(c)(3) organization at any time. In summary, you can give three years’ worth of gifts this year to take a large charitable deduction, but then continue to give to your designated charities from the account each year as normal. Keep in mind there are limits on how much you can deduct depending on the type of charity and how much you give in one year relative to your adjusted gross income.

Investment Tax Planning

You can also implement tax planning strategies within your investments. Strategies like tax-loss harvesting, asset location planning, and increasing your tax-equivalent yield can play a significant role in reducing the amount of taxes you pay.

Tax-loss harvesting involves selling investments that have decreased in value to offset gains from other investments. By doing so, you can reduce your tax liability on capital gains. The losses can be used to offset an equal amount of gains, reduce your taxable income by up to $3,000 per year, and any excess losses can be carried forward to future tax years.

Asset location planning involves strategically placing different types of assets in different types of accounts, such as tax-deferred retirement accounts, taxable brokerage accounts, and tax-free accounts like Roth IRAs. This allows you to maximize tax efficiency by placing assets that generate the most taxes in tax-advantaged accounts and assets that generate less taxes in taxable accounts.

Increasing your tax-equivalent yield involves finding investments that provide tax benefits or tax advantages. For example, municipal bonds are exempt from federal taxes and, in some cases, state and local taxes, so they can provide a higher after-tax yield than comparable taxable bonds. Similarly, investing in dividend-paying stocks can provide favorable tax treatment for qualified dividends, which are taxed at a lower rate than ordinary income.

Partner with a Trusted Financial Advisor

This blog is simply meant to introduce these tax-saving strategies. It’s important to partner with an investment advisor to determine if a certain strategy is appropriate for you in the context of your overall financial plan. As a Registered Investment Advisor, Tull Financial Group offers tax planning services and stays up to date on the latest tax laws and regulations to determine how it may affect your financial plan. In addition, we help guide you through life’s transitions to ensure you aren’t paying more than your fair share in taxes. We collaborate with your tax preparer to help maximize your tax savings and ensure that you are withholding an appropriate amount to avoid any tax penalties down the road. If you are looking for a trusted financial planning firm that focuses on income tax planning, call us today for a free consultation.

To wrap up today’s lesson, it’s time for your final exam! It’s been a pleasure having you in our class this semester. No cheating.

- You believe you are in a lower tax bracket relative to your future tax bracket during retirement. It may benefit you to contribute to a _______ 401(k) plan.

- Pre-tax or traditional

- Roth

- Zero

- No idea

- The amount that is converted grows tax free within the Roth IRA and qualified distributions are taxable.

- True

- False

- A _____________ allows you to take a charitable deduction when funds are transferred into the account and then give to any 501(c)(3) organization at any time.

- Individual Retirement Account

- Flexible Spending Account

- Donor-Advised Fund

- 529 Account

- ___________ involves selling investments that have decreased in value to offset gains from other investments.

- Asset location planning

- Increasing your after-tax yield

- Roth conversion

- Tax-loss harvesting

- As a Registered Investment Advisor, Tull Financial Group provides tax planning services and stays up to date on the latest tax laws and regulations to determine how it may impact your financial plan.

- True

- False

Quiz answers:

- B

- B

- C

- D

- A