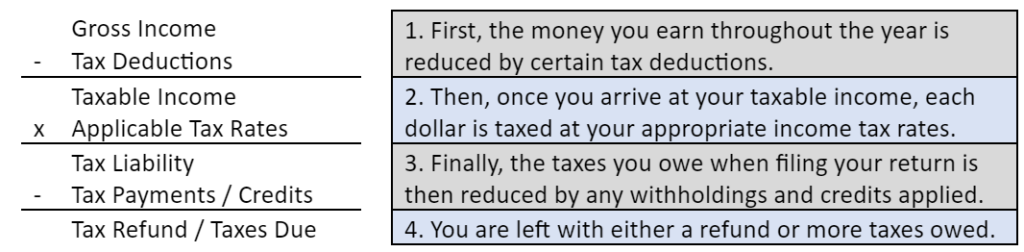

Hello again, and welcome to another addition to our four-part series called, Tax Planning 101. If you read our last two blogs, you learned about the income tax equation, tax deductions, tax brackets, tax filing statuses, etc. If you haven’t read the previous two blogs just click here to read the first one and click here to read the second one. In today’s blog we are going to answer this simple question: “What are tax credits and tax withholdings?” Once we provide a general overview, we will then dive into how credits differ from deductions, and then wrap up with tax refunds or taxes due. Before we get started, let’s review the basic income tax equation for all U.S. taxpayers:

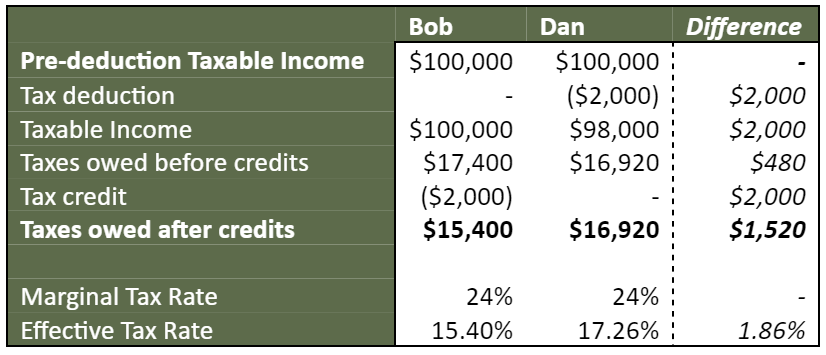

Over the past few blogs, we’ve worked our way down to the tax liability part of the equation. Today, we’ll focus on tax credits and withholdings to then arrive at our final tax bill/refund. Tax credits and tax deductions are talked about together most of the time – but they are very different. As previously mentioned, tax deductions reduce the base amount of your taxable income, leaving you with less taxable income to pay taxes on. On the flip side, tax credits are a dollar-for-dollar reduction of your taxes owed. What do I mean by dollar-for-dollar? Once you determine your taxes owed, tax credits reduce your tax bill, not just the income that your taxes are based on, thus creating a greater impact on your tax bill! Let’s look at the example below to help visualize – that’s right, Bob and Dan are back! Let’s assume that both Bob and Dan have $100,000 in taxable income but that Bob receives a $2,000 credit by using the child tax credit whereas Dan decides to contribute $2,000 to his pre-tax IRA (deduction).

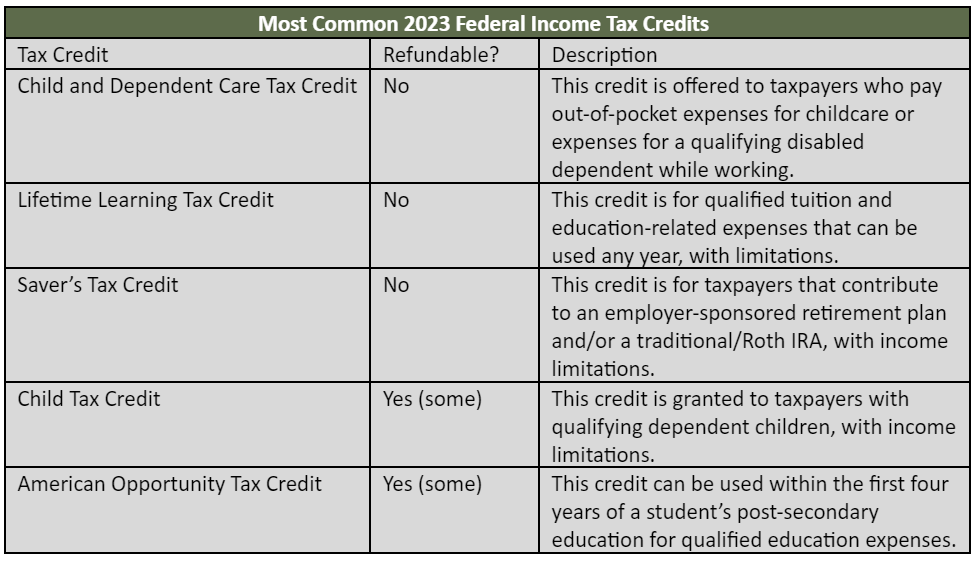

Tax credits are split into two different categories: refundable and non-refundable. A refundable tax credit means that if your tax liability (tax bill) is less than the total value of the credit, you can receive a tax refund for the difference. In contrast, a non-refundable tax credit will lower your tax liability down to $0, but you will not receive the net amount of the tax credit as a refund. This means that some tax credits are more favorable than others depending on your tax liability. Let’s take a look at some of the most common tax credits that you may come across:

Now, let’s discuss the last part of the puzzle to reach your taxes owed/refund… the taxes you have already paid. After reducing your tax liability via tax credits, you then must find out how much tax you have already paid throughout the year. That’s right, one common misconception is that all taxes are due on April 15th. However, it is a pay-as-you-go system, either through paycheck withholdings or estimated tax payments. Paycheck withholdings would be for W-2 employees, where your employer withholds money each time you are paid, and sends those payments to Uncle Sam throughout the year. For people who either do not withhold enough or are self-employed, they are required to send estimate tax payments to the IRS on a quarterly basis. We keep it high-level for today, but click here to check out our video entitled, “Tax Withholdings – How do I know what to put on my W-4?” where we walk through pre-payment penalties, over- or under-withholding, and more.

I know most of you are just dying to keep reading about taxes, but we’re going to keep this blog short(er) today. To this point, we have walked through a high-level overview of how income is taxed at a federal level. Now, some of you may be thinking, “What about capital gains? What about state taxes? What about Social Security and Medicare taxes?” While we may hit on these subjects in another blog series (depending on whether you liked this or not), it is just too much to cover in one post (or even series of posts). Moving forward, I like to always ask myself, “Now what?” You’ve learned all of these different tax-related topics, but now how can you use that information to better yourself? For our final blog in this “Income Tax 101” series, we will be diving into tax planning strategies you can implement to lower your tax bill.

As you might have guessed, it’s quiz time. Good luck – there is no extra credit, so don’t ask.

- A $1,000 tax deduction reduces your taxes owed more than a $1,000 tax credit.

- True

- False

- I don’t know.

- I don’t care.

- All of the following tax credits are nonrefundable, except:

- Child Tax Credit

- Child and Dependent Care Tax Credit

- Saver’s Tax Credit

- None of the above.

- Estimated tax payments are due on a ________ basis.

- Weekly

- Monthly

- Quarterly

- Bi-annual

- The IRS typically will calculate your underpayment penalty for you, but in certain circumstances, you may have to calculate your own penalty amount on Form ______.

- 2210

- 1040

- 1234

- I, sadly, did not watch the video.

- The final blog will cover _____________ strategies to reduce your overall tax bill.

- Investment Planning

- Retirement planning

- Insurance planning

- Tax planning

Quiz answers:

- B

- A

- C

- A

- D