How to Find the Perfect Financial Advisor for You

by Robert W. Tull | January 9, 2020 | Financial Planning, Wealth Management

People generally begin the search for financial planning services for one of two reasons. Either they have amassed a certain amount of wealth and they’re not sure how to best grow and maintain it, or they want to figure out how to create and save more wealth. The goals behind these two reasons, however, vary greatly, and defining them first will help in choosing the right Financial Advisor for your needs.

There are many reasons to save, maintain and grow wealth. The most common is for income after retirement, but you may also be saving for a specific event or item like a college fund or an investment property. Before seeking out a financial advisor, it’s best to sit down with your spouse or loved ones to discuss your future financial goals.

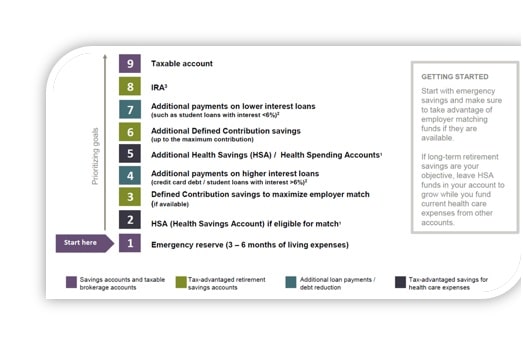

Prioritizing Long-Term Savings is a great place to start!

Once you have your financial goals in place it may be time to begin your search for a financial professional that fits your needs. Most people find wealth management advisors or financial planning services through recommendations by friends and family, and this is a great place to start. However, just because a certain advisor is great for one person, doesn’t mean he or she will be the right fit for you. Collect the names of those advisors who were personally recommended, then do your research. Go to their website and check to see if it looks professional. Do they have the qualifications and experience to make you feel comfortable sharing your personal financial information with them? Do their services align with your goals? Are they fee-based or fee-only?

The National Association of Personal Financial Advisors (NAPFA.org) is a great place to look for recommendations as well. All advisors on their website are members of this professional organization and are held to certain industry standards. You can review the advisor’s or firm’s Form ADV at SEC.gov to dig into their compensation, services and disciplinary history.

You should also note whether the advisor works on their own or within a larger financial group. Some people may like working with one individual all the time, while others may feel more comfortable having advisors with multiple viewpoints, areas of expertise and additional contact points in case their primary advisor isn’t available.

From this research, create a short list of candidates and start making phone calls. Who is easy to get in touch with? Was the person who answered the phone helpful and knowledgeable? How long will you have to wait to get in with an advisor? Set up appointments with those offices that make a good first impression. Think of your first in-person meeting with each advisor as an interview of sorts. Use this time to ask questions about your specific goals and how the advisor may be able to help you achieve them. NAPFA offers a Financial Advisor Diagnostic Tool on their website that includes questions and a handy answer key of recommended responses. But remember that at the end of the day, you must also have a personal comfort level and connection with the person you choose, as you will be sharing a lot of information with him or her and entrusting that person to help you reach big life goals.

Once you have chosen your advisor, the communication should remain consistent. Beyond the performance of your money, you should also be evaluating the office or individual. Are they attentive? Do they keep you informed? Are they addressing your specific concerns and goals? Keep in mind that Financial Advisors aren’t magicians—they can’t make your money grow by leaps and bounds in short amounts of time, especially in a volatile market. But with a plan and method in place you should be able to see progress toward your goals over time as you maintain a long-term focus. Remember, you are never stuck with a financial advisor. If you feel like you are not getting the financial planning services or attention that you want, it may be time to go back to the drawing board.

Disclosure:

1.Must have a high-deductible health insurance plan that is eligible to be paired with an HSA. Those taking Social Security benefits age 65 or older and those who are on Medicare are ineligible. Tax penalties apply for non-qualified distributions prior to age 65; consult IRS Publication 502 or your tax advisor.

2.This assumes savings in a diversified portfolio may earn 6% over the long term. Actual returns may be higher or lower. Generally, consider

making additional payments on loans with a higher interest rate than your long-term expected investment return.

3.Income limits may apply for IRAs. If ineligible for these, consider a non-deductible IRA or an after-tax 401(k) contribution. Individual situations will vary; consult your tax advisor.

Source: J.P. Morgan analysis; not intended to be a personal financial plan.