3 Foundational Components to Consider When Performing Tax-Loss Harvesting

by Phil Tull | November 30, 2022 | Financial Planning, Tax Planning

When the market experiences heightened volatility, resulting in negative performance, it can have a significant impact on investments. Though account values may look disheartening for many this year (as the S&P 500 was -17.13% as of November 21st, 2022), it may be possible to find a silver lining to cheer you up. Well at least a little. When it comes to what financial professionals refer to as “tax loss harvesting” it can be a bit puzzling as there are various components to consider. Understanding the basic knowledge surrounding tax loss harvesting is a great place to start. So, we have provided three foundational components to know and consider when performing tax loss harvesting.

- Counteract gains with losses

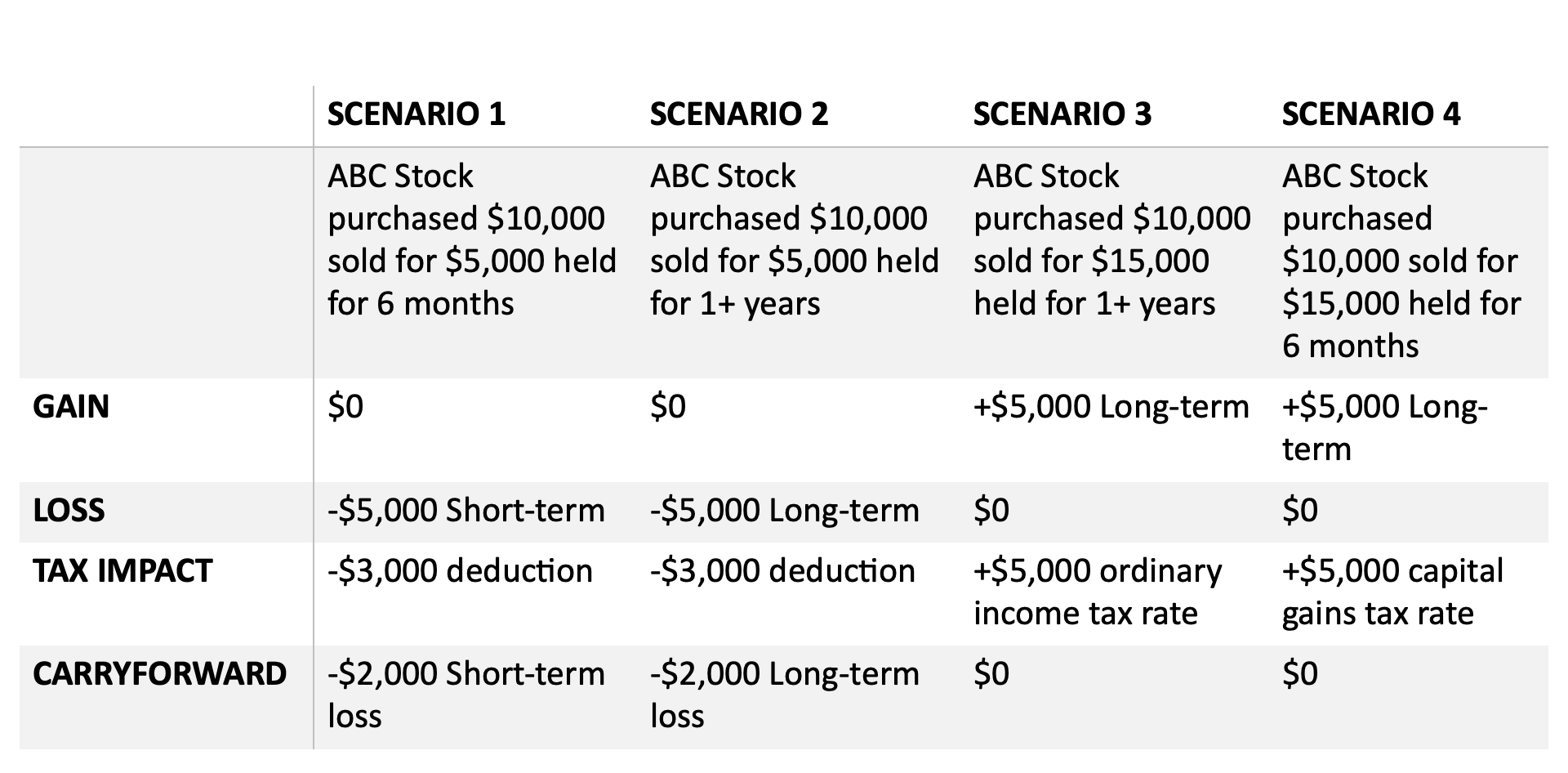

- Gains realized through the sale of a financial asset are taxable at one of two rates depending on how long they are held (see below). However if you hold assets that have gone down in value, below the cost basis (price it was purchased at), you may have the opportunity to sell these positions and recognize the loss to off set your gains for the tax year. Depending on how long you have held the security and which tax bracket you are in, this can amount to substantial tax savings.

- Reinvestment of positions within 30 days of your tax loss harvest sale, can be a tricky piece to this puzzle. Be sure to brush up on wash sale rules to guide you on what positions you should purchase to stay in the market but still recognize those losses for tax purposes.

- Short term vs long term gains/losses

- Short term holdings are those held for one year or less. For tax purposes the IRS recognizes these positions at ordinary income tax rates, which are generally higher than long-term capital gains rates.

- Long term holdings are those held for more than one year and taxed at capital gains rates (15% and 20%)

- Income deduction

- If your capital losses exceed your capital gain you are able to use up to $3,000 ($1,500 if married filing separately)

- Carryforward losses

- Any losses that are not used after counteracting gains and the income deduction limit can be carried over to future years. The losses can be then be used in the same manner each year until they are used up.

- Document your carryforward losses on the Schedule D Tax Worksheet to track and continue using losses until they are fully used.

If you are like me, you like to see examples and scenarios. Though these are by no means exhaustive, here are a few simple scenarios you may find yourself in this year.

Your taxes and personal financial picture are unique and each piece should be analyzed to ensure it suits your financial goals. It is good to consult professionals for expertise in these areas when making your decisions. If you’re looking for a trusted CERTIFIED FINANCIAL PLANNER™ professional whose fiduciary duty is to you and your wealth only, call Tull Financial Group today at 757.436.1122 to see how we can help you plan for your loved one’s future.