Most people have at least a general understanding of how the U.S. income tax system works, being that the infamous Form 1040 (the U.S. Individual Income Tax Return) was created back in 1913. Whether you have filed your own taxes for the past 30 years, or all you know is that something happens on April 15th, we want to provide an overview of the U.S. income tax system as well as the benefits of tax planning in our four-part blog series called, Tax Planning 101.

At the end of this blog series, we want you to have a general understanding of individual income taxes and how tax planning can add value to your portfolio. While these questions may not come up during your family’s Thanksgiving dinner, after reading through our four-part series you should feel comfortable answering the following:

- What are tax deductions and how might they impact my taxes owed?

- What is my marginal tax bracket?

- How can tax credits help? What are common tax credits to be aware of?

- What are potential tax-saving strategies that may lower my tax bill?

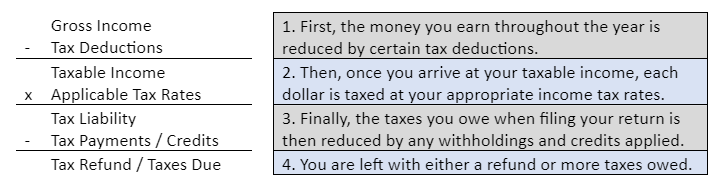

Before we begin, let’s take a look at the basic individual income tax equation:

This blog could reach 100 pages and still not cover all there is to know about individual income taxes. Thankfully for you, we are going to avoid the novel and get straight to the point. The first step in the equation above is your gross income. Your gross income is any income you receive before taxes and deductions are taken out. In its most simplistic definition, gross income is just that, your income. This can include things such as your wages, salaries, tips, pension benefits, interest, dividends, realized capital gains, rental income, etc.

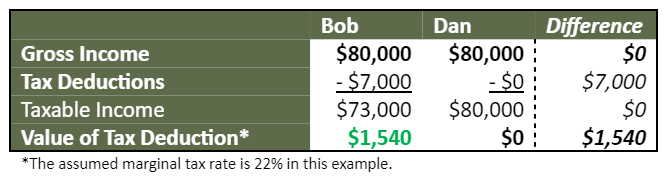

Now, instead of making you pay taxes on every single dollar of income you earn, Uncle Sam provides opportunities for us to lower our income for income tax purposes, which results in a lower tax bill. Tax deductions are awarded as a way to incentivize taxpayers to do certain things or provide relief for taxpayers depending on their situation. The government offers tax deductions to taxpayers to encourage them to save for retirement, gift to charities, or even buy a house. Also, tax deductions are provided in an attempt to provide relief such as the student loan interest deduction, the tuition and fees deduction, the medical expenses deduction, and so on. Tax deductions are subtracted from your gross income, which in turn allows you to pay tax on a lesser base amount of income. Let’s take a look at a general example to show how tax deductions can save you money. In this example, Bob gets a $7,000 deduction for contributing to his IRA. Dan does not contribute, and thus does not receive a tax deduction:

Our next blog will dive into the marginal taxes rates and how income is taxed – so we won’t focus on that for now. In the example above, the tax rate was 22%. So, since Bob was able to invest $7,000 towards his retirement, Uncle Sam didn’t make him pay tax on that income this year, he was able to defer that income. At the 22% marginal rate, he saved a grand total of $1,540 in income taxes for the year!

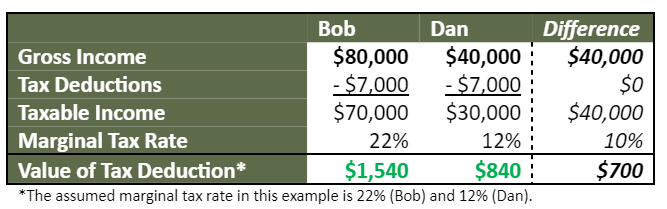

To expand on the example further, let’s look at the value of tax deductions. Is a $7,000 tax deduction worth the same to everyone, regardless of income? If you said “no” you get a gold star. The example below provides an illustration of how the value of your tax deduction is dependent upon your marginal tax rate – the rate at which each additional dollar of income is taxed. To adjust our example, let’s say that both Bob and Dan contribute $7,000 to their traditional (pre-tax) IRAs, except Dan’s income is now at $40,000 instead of $80,000.

Both individuals contributed $7,000 to their retirement accounts, however Bob’s contribution saved him more in taxes. We won’t get into the politics around the tax code – in our next blog you will see that Bob is paying more in taxes overall – but you can see that tax deductions are worth more for taxpayers in higher marginal income tax brackets.

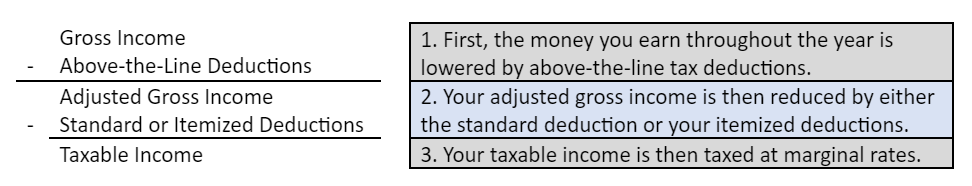

Now that we have provided an overview of tax deductions and their impact on the total tax you pay, let’s look into the two different types of tax deductions: above-the-line deductions and below-the-line deductions. Now, you may be wondering, “What is the line?” I’m glad you asked. The line refers to your adjusted gross income (AGI). Zooming in closer to our income tax equation, you’ll see that gross income is then reduced by above-the-line deductions to reach your adjusted gross income, which is then reduced again by either the standard deduction or itemized deductions to reach your taxable income.

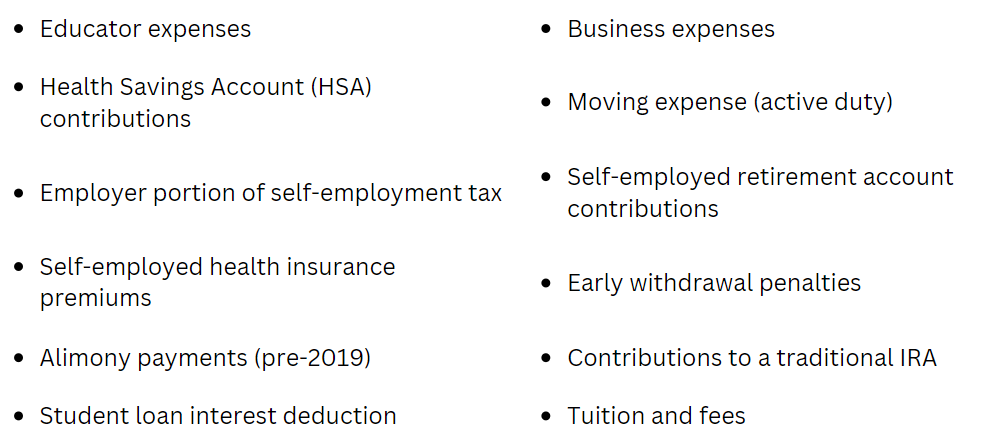

Above-the-Line Deductions are adjustments to your gross income used to calculate your adjusted gross income. These deductions include but are not limited to the following:

Now, you may be wondering, “What was the purpose of calculating my AGI?” Your adjusted gross income (AGI) is used:

- To determine if you qualify for certain deductions (tuition and fees deduction, medical expense deduction floor, charitable contribution deduction limit, etc.),

- To determine whether you can contribute to certain tax-advantaged accounts (Roth IRAs),

- As a “starting point” for most state tax returns, etc.

After calculating your adjusted gross income (AGI), you then reduce your income again by either using the standard deduction or by itemizing your deductions. The standard deduction for tax year 2023 is set at $13,850 for single filers and $27,700 for married couples filing jointly. There are also additional deductions depending on whether you or your spouse are above age 65 or blind ($1,850 extra for each if single; $1,500 extra for each if married). This means that for a married couple ($27,700), both over the age of 65 (+ $1,500 + $1,500), and one spouse is blind (+ $1,500) would be eligible for a standard deduction of $32,200 for 2023.

If, however, that same couple has a greater number of itemized deductions, they can use that amount instead. Itemized deductions include, but are not limited to, the following:

- Medical and dental expenses: Qualified expenses may include prescriptions, co-pays, insurance premiums, etc. You may only deduct the amount of the qualified expenses if they exceed 7.5% of your adjusted gross income.

- Example: John’s adjusted gross income is $50,000. John also has qualified medical expenses of $5,000. John can deduct $1,250 [$5000 – ($50,000 x 7.5%)].

- Taxes you paid: This would include any real estate and property taxes as well as state and local income taxes paid. As of the Tax Cuts and Jobs Act of 2017, this deduction is limited to $10,000, which has heavily impacted taxpayers in high-taxed states such as New York, California, New Jersey, etc.

- Interest you paid: Most people with a home mortgage can deduct the interest they pay on the loan.

- Gifts to charity: You may be able to deduct contributions to qualified charities as well. This deduction is limited depending on the type of gift (cash or appreciated property) as well as what type of charity you are gifting to (public or private).

After subtracting your deductions, by either using the standard deduction or itemizing your deductions, you arrive at your taxable income. This is the number used when calculating your taxes owed – which we will cover in our next blog. In summary, we defined what your gross income is, and then subtracted out certain adjustments to income (above-the-line deductions) to reach your adjusted gross income. We noted that this number, your AGI, is used as a baseline to qualify for deductions and other things. Then, we took the AGI and subtracted either the standard deduction or itemized deductions to calculate your taxable income. Be on the lookout for the next “Income Tax 101” blog, and for those of you that are still with me – thank you! While this will not be graded, try out the quiz below to test your knowledge on tax deductions!

- Gross income – Tax Deductions (both above-the-line and below-the-line) = ____________.

- Taxable income

- Standard deduction

- Adjusted gross income

- Taxes owed

- All of the following are examples of gross income, except:

- Bob works at a local grocery store and gets paid hourly.

- Sarah is a manager at a toy store and receives a salary paid twice a week.

- Mary withdraws money from her savings account monthly.

- Dan works at a restaurant and receives tips as a waiter.

- Tax deductions are worth the same to everyone, regardless of income.

- True.

- False.

- I don’t know.

- I don’t care.

- Which of the following are above-the-line deductions?

- Contributions to a traditional IRA.

- Health Savings Account contributions.

- Student loan interest deduction.

- All of the above.

- Some of the most common itemized deductions are:

- Medical and dental expenses, taxes you paid, IRA contributions, 401(k) contributions.

- Gifts to charity, tuition and fees, moving expenses, interest you paid.

- Medical and dental expenses, taxes you paid, interest you paid, gifts to charity.

- Interest you received, Tax refunds you received, gifts to my dentist.

Quiz answers:

- A

- C

- B

- D

- C