How Medicare Open Enrollment Scams Can Damage Your Financial Planning

by Amy Pucci | September 29, 2022 | Financial Planning, Medicare Open Enrollment

Healthcare is an integral part of American life, and ensuring you are covered during retirement should be at the forefront of your financial planning. Even with careful planning, Medicare open enrollment scams can damage your benefits and leave you vulnerable to identity theft. Protect yourself and your money with a trusted financial advisor like Tull Financial.

Importance of Medicare in Retirement Planning

While planning for retirement, healthcare insurance is an essential aspect of your financial planning. For many retired individuals, healthcare is one of the largest expenses that take up your monthly/annual budget. Signing up for Medicare is an optimal way to reduce this expense and still ensure your health is taken care of. In order to properly plan for retirement, you will need to plan for Medicare costs and select a plan that meets your needs.

There are a variety of Medicare plans that you can choose from, including:

- Part A (Hospital Costs)

- Part B (Medical Costs)

- Part C (Medicare Advantage—Covers dental, vision, etc.)

- Part D (Prescription Drugs)

Depending on the type of medical coverage you need, you must enroll in the correct Medicare plan.

Enrolling in Medicare

Enrolling in Medicare is available 3 months before and after your 65th birthday. However, if you fail to enroll in this 7 month period, your premiums for Medicare coverage could increase. In addition, there is an open enrollment period every year where Medicare customers can change their Medicare Advantage and Prescription Drugs coverage.

Beware of Medicare Open Enrollment Period Scams!

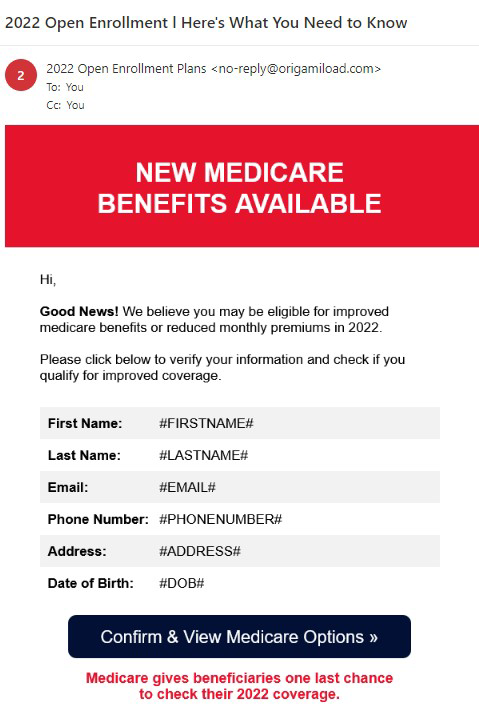

Medicare’s annual Open Enrollment Period is fast approaching. October 15th through December 7th each year is the time when one may make changes to their Medicare coverage. Stay tuned for more information on this in the coming weeks! In the meantime, you may find that you are receiving emails like the one below or even phone calls.

You may safely review your Medicare Open Enrollment options through the Medicare.gov website or by contacting a local insurance agent or broker. Each state also has its own State Health Insurance Assistance Program (SHIP), where trained and certified counselors may assist with meeting your coverage needs.

Rely on Trusted Sources such as Tull Financial Group

In summary, ignoring emails or phone calls related to Medicare Open Enrollment may be beneficial. Over the next few weeks, take time to review your current coverage, your current coverage needs, and the Medicare website. Then, consult with a trusted insurance agent if you feel you need to make changes to your coverage.

Tull Financial is a trusted resource for all things related to financial planning, wealth management, and retirement planning. Call us at 888.296.7526 or visit our website to speak with a financial advisor and ask questions about your retirement plan and how to make the most of your Medicare coverage.