Spending or Savings: A Different Approach to Retirement

by Phil Tull | October 7, 2025 | Retirement Planning

The Retirement Staircase: A Spending Analogy That Hits Home

You ever walk down a few flights of stairs and not think anything of it—until you have to walk back up? That’s retirement planning in a nutshell. Going down is easy. Spending more as your income grows feels natural. But climbing back up—cutting back in retirement—is much harder.

This analogy reflects a key concept in retirement spending habits: it’s easier to increase spending than it is to reduce it later. That’s why understanding your spending rate is more important than just focusing on how much you save.

Reimagining the Retirement Puzzle

Most people ask:

“How much do I need saved by the time I retire?”

But a more practical question is:

“How much do I need to spend to live comfortably in retirement?”

This shift in mindset helps align your retirement lifestyle expectations with your actual financial resources.

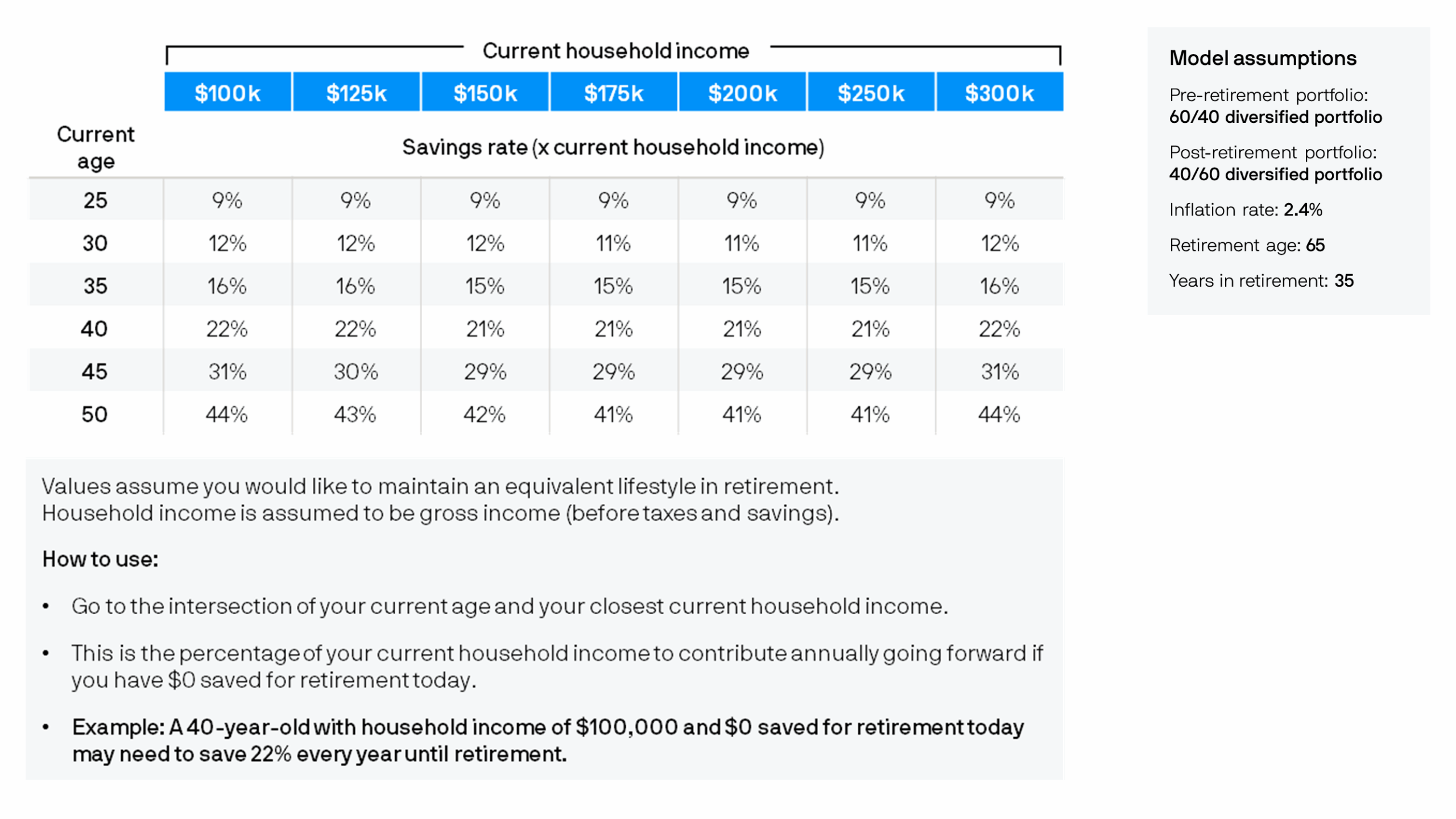

Source: JPMorgan Guide to Retirement

Spending Habits: From $40K to $200K

When you begin saving for retirement, your lifestyle may reflect a $40,000 annual salary. Your savings goals match that. But as your career progresses, your spending habits may resemble earnings of $200,000 annually.

Which lifestyle do you expect to maintain in retirement? Likely the latter—because it’s harder to cut back than it is to spend more. That’s the uphill climb.

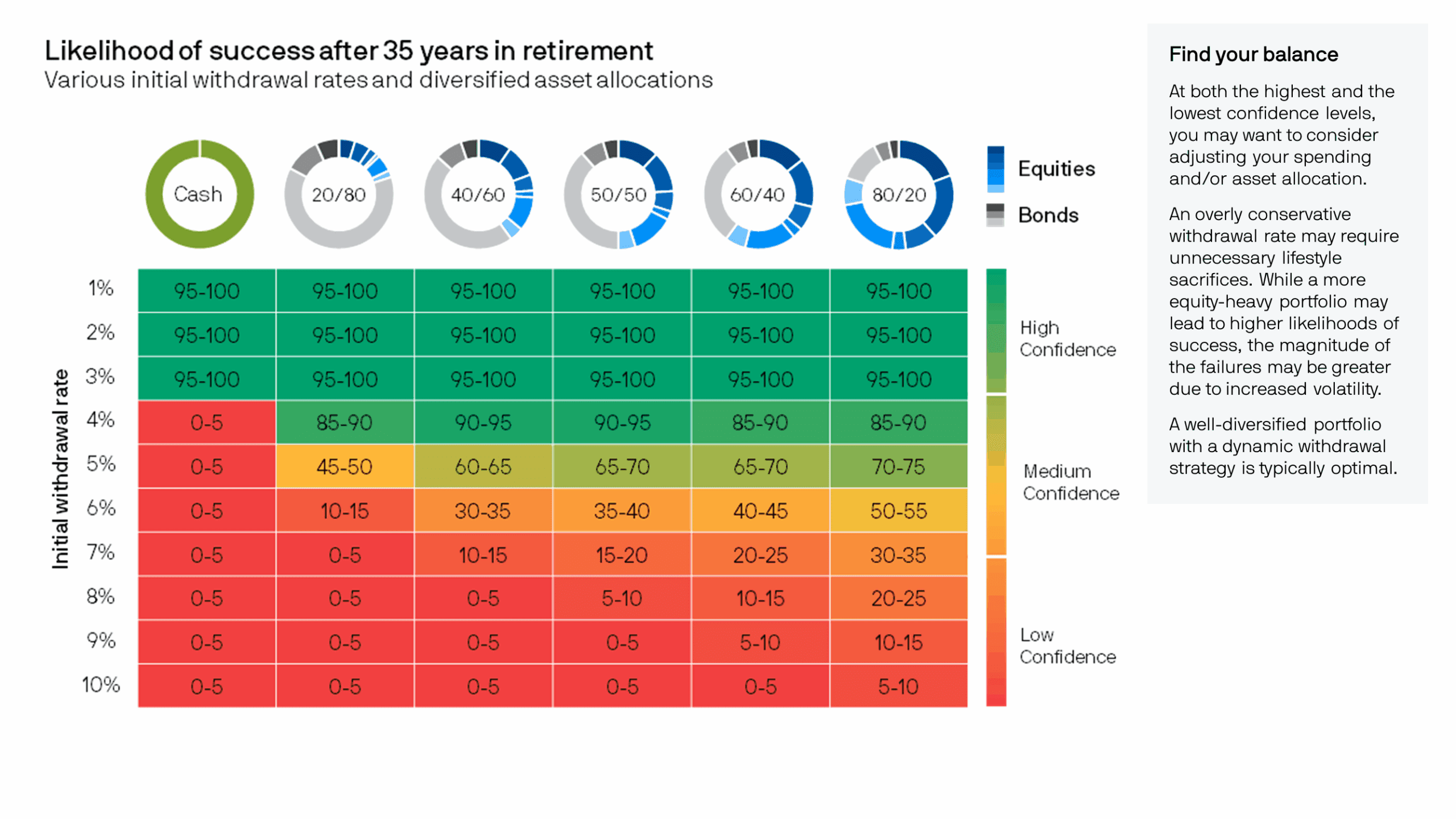

Why the Withdrawal Rate Matters

Let’s say you retire with $1 million. Using the 4% withdrawal rule, you’d have $40,000 per year to spend. That might match your early-career lifestyle—but not the one you’ve grown accustomed to.

Your Options:

- Save more to support a higher spending rate.

- Spend less to align with your savings.

- Adjust expectations to find a sustainable middle ground.

Three Critical Retirement Planning Factors

-

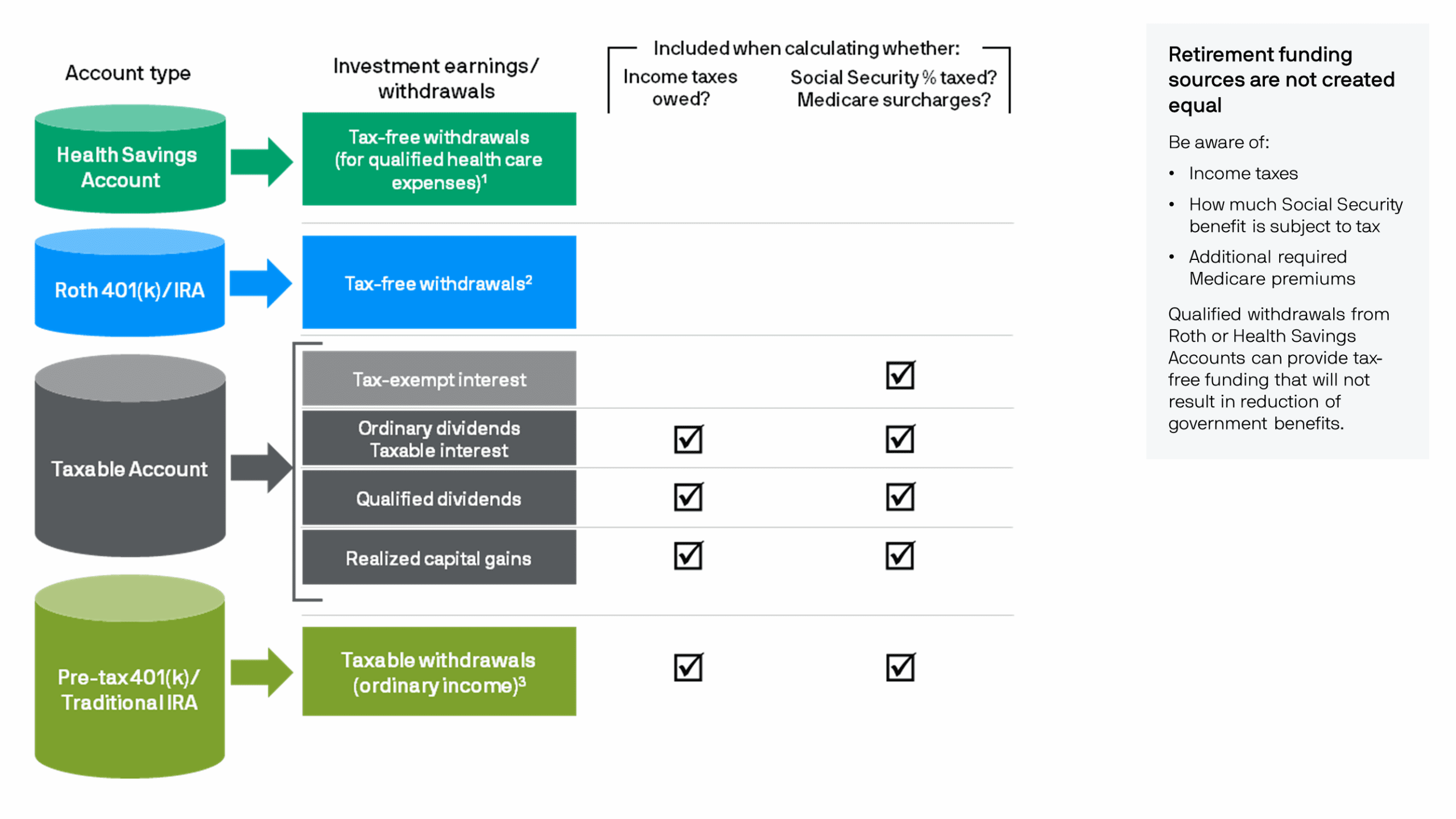

Pre-Tax vs. Post-Tax Dollars

Retirement accounts like 401(k)s and IRAs often hold pre-tax dollars. Once withdrawn, taxes reduce their real value. A million-dollar value 401(k) may look more like $750k in spending capital. A $100,000 withdrawal might only net $75,000 depending on your marginal tax bracket.

Source: JPMorgan Guide to Retirement

-

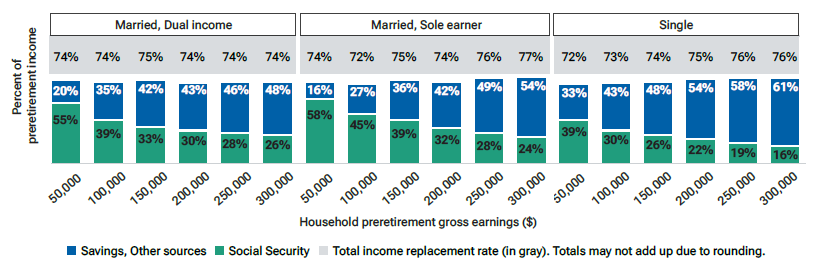

Social Security Benefits Shrink with Income

Social Security replaces a smaller percentage of income for higher earners. If you made $40K annually, it might cover 40–50%. But if you earned $200K, it may only replace 20–25%.

Source: T. Rowe Price

-

Inflation-Adjusted Returns

A 7% investment return sounds great—until inflation eats away at it. If inflation runs at 3%, your real rate of return is closer to 4%. That difference can eat into spending power of your dollars over time.

Final Thought: Know Your Staircase

Retirement planning isn’t just about saving—it’s about understanding your spending trajectory. The climb back up is harder than the descent, so it’s essential to plan for the lifestyle you want, not just the nest egg you think you need.

Source: JPMorgan Guide to Retirement

Partner with a knowledgeable financial planning team that takes a dynamic, personalized approach to your retirement goals. Contact TFG today to start building a retirement strategy tailored to your unique needs and future aspirations.