Tax Loss Harvesting: Combating Inflation and a Lagging Market

by Robert W. Tull | July 6, 2022 | Financial Planning, Tax Planning

The Labor Department announced earlier this month that the consumer-price index increased 8.6% in May from the same month a year ago, marking its fastest pace since December 1981. This was above analyst expectations of 8.3% and sent U.S. stocks down as consumer sentiment dropped along with them. With ongoing inflation and a lagging stock market, you may feel like there’s not much you can do to help your portfolio. But there is one strategy that may seem counterintuitive: selling at a loss.

Selling some of your stock holdings at a loss is a legitimate tax strategy that takes advantage of the notably generous tax code for personal losses in taxable accounts. According to Joel Dickson, a tax specialist who is the global head of advice methodology for Vanguard Group, “Tax losses are a potential asset that can lessen the sting of market downturns.” By selling shareholdings at a loss, investors offset capital gains from investment winners. Even if an investor didn’t have capital gains on other investments, he or she can still deduct up to $3,000 of those losses from ordinary income (wages or interest) come tax time.

It’s important to note that there’s nothing nefarious or illegal about this tax strategy, however, there are some rules that keep investors from over-gaming the system. The tax code postpones the use of losses if an investor purchases a “substantially identical” security within 30 days before or after selling a losing stock. These are often referred to as “wash sales.” The rules here are not hard and fast in terms of exactly what “substantially identical” means to the IRS, which is why working alongside an investment advisor is a good idea.

There are some investors who may not benefit from tax-loss harvesting as much, and those are individuals who make charitable donations. Rather than offsetting short-term capital gains with losses, donating these assets could be more tax-efficient. In many cases, a donor will not only not have to pay taxes on any potential appreciation, but they will also be able to claim the charitable deduction as well.

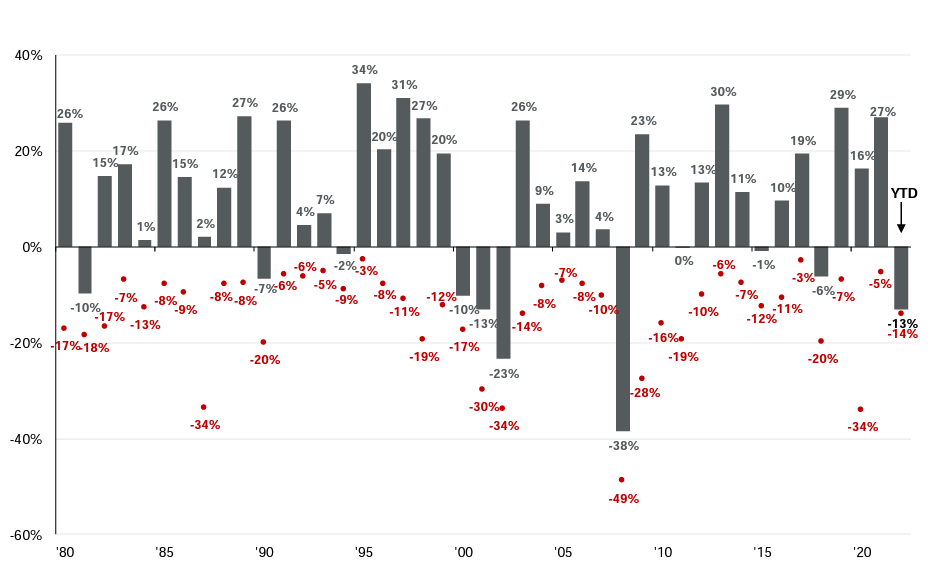

While tax-loss harvesting, charitable donations, and other strategies may help mitigate the current status of your portfolio or tax bill, we continue to encourage our clients to keep their eyes on the long-term. Market volatility is not novel.

While seeing red in your portfolio can be disappointing in the short term, remember that they are all unrealized losses until you sell. Even from our biggest recession in 2008, the stock market rebounded to normal levels, and there’s no reason to believe the American market will do anything differently this time around. That said, it’s always a good idea to take advantage of tax strategies when possible.

If you have questions about investment and tax strategy or want to get started on investing for your future, Tull Financial Group can help. Contact our office today or call us on 757.436.1122 and let’s get started on a retirement plan that’s right for you.