Missing Out on Tax-Free Growth? Here’s the Roth IRA Guide

by Drew Overton | April 22, 2022 | Retirement Planning, Tax Planning

Ever since they were first established back in 1998, Roth IRAs have been a game-changer in the retirement world. After years and years of only pre-tax retirement vehicles, Roth IRAs provided another way for savers to put money aside for the future. That said, let’s dive into what a Roth IRA is, who can use it, and look at potential reasons why you should consider opening one for yourself.

What is the difference between a traditional IRA and a Roth IRA?

First, you have to understand what an IRA is. An IRA is an individual retirement account. Its purpose is to provide a tax-advantaged way for people to save for retirement. There are two main types of IRAs: traditional and Roth.

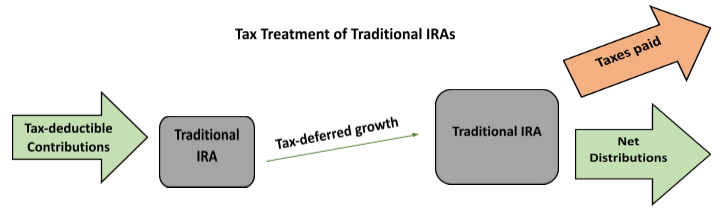

The main difference between a traditional and a Roth IRA is when you pay taxes. For traditional IRAs, your contribution is pre-tax, meaning you are not taxed on the amount contributed to the account. While the funds are invested within the retirement account, assets grow tax-deferred until distribution. Then at retirement, qualified distributions from the traditional IRA are fully taxable. The illustration below shows the tax-treatment of traditional IRAs.

Quick note on the term tax-deferred: Retirement accounts provide tax-deferred growth, which allows for tax-free treatment of any transactions within the account. Capital gains, interest, and dividends within a retirement account are not taxable. The only time anything is taxed is when funds leave the IRA – a transfer out of the account. This is a major advantage, especially for more active investors.

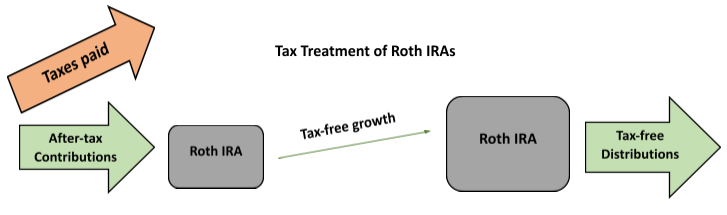

Roth IRAs, as you might have guessed, reverse the tax treatment. Contributions are after-tax so the funds both grow and are distributed tax-free. The big difference here is that you do not receive a tax deduction for your contributions to the Roth IRA. The figure below shows how funds are taxed, how they grow, and how distributions are treated when utilizing a Roth IRA.

Contribution Limits for Roth IRAs

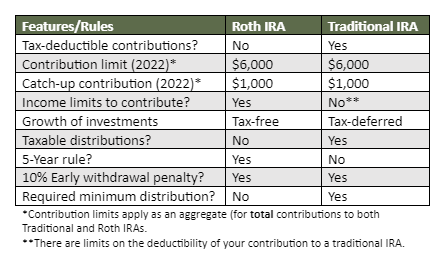

While most of the rules discussed below will apply to both traditional and Roth IRAs, we will strictly focus on rules pertaining to Roth IRAs. There is no age limit for when you can contribute to a Roth IRA. Contributions can be made as late as the tax filing deadline for that tax year.

You must have earned income in the year that you wish to contribute to a Roth IRA. For 2022, an individual may contribute up to $6,000, and an additional $1,000 as a “catch-up” contribution, if 50 years old or older. You must have earned income of at least $6,000 (or $7,000 if over age 50), if not, your contribution is limited to your earned income for that year.

Please note that this is an aggregate limitation. If you decided to contribute to both a traditional and a Roth IRA, your total contributions to both cannot exceed the $6,000 limit (or $7,000 if 50 years or older).

Example: Angela (54), made $10,000 this year in earned income. She can contribute up to the contribution limit of $7,000. Brad (54), however, only earned $4,000 this year. His contribution is limited to $4,000 for 2022.

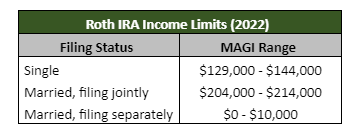

Unlike 401(k) plans, Roth IRAs have income limitations on who can contribute. For 2022, your modified adjusted gross income (MAGI) must be lower than the following limits to contribute to a Roth IRA. As your MAGI reaches the upper limits of the phase-out ranges, the amount you are allowed to contribute is reduced.

Example: Angela is 54 years old. Her modified adjusted gross income for 2022 is estimated to be $136,500. Because her tax filing status is single, she falls within the limits for a Roth IRA contribution. That said, Angela can contribute up to $3,500 to her Roth IRA for 2022.

Distribution Rules for Roth IRAs

The 5-Year Rule: A unique requirement for Roth accounts, called the 5-year rule, requires five years to pass from the date of the initial contribution before any qualified distributions can be made – if not, taxes are assessed on the growth of the Roth IRA.

If you decide to roll your Roth 401(k) plan into a Roth IRA, remember that the five-year clock is separate for both accounts. Specifically, if you have had (and contributed to) your Roth 401(k) for over 5 years, but recently opened a Roth IRA to receive the rollover, the five-year clock resets for the Roth IRA. Be sure to meet with a financial planner to guide you through this process, as many of these rules can be complex.

10% Early Withdrawal Penalty: First it is important to note that the contributions to your Roth IRA are always available to withdrawal, tax-free and penalty-free. However, there are some instances where the growth within your Roth IRA could be subject to a 10% penalty, depending on the situation.

Generally, distributions from a Roth IRA before you reach age 59 ½ may be subject to the early withdrawal penalty, unless the distribution is for one of the following reasons:

- a down payment for a first-time home purchase

- qualified education expenses

- qualified expenses related to birth or adoption

- death or disability

- unreimbursed medical expenses or health insurance (unemployed)

- substantially equal periodic payments

Required Minimum Distributions (RMDs): There are no RMDs for Roth IRAs. Considering the account’s tax-free nature, paired with no distribution requirements make it a great tool to pass tax-free money to your heirs. Remember, as of the 2019 SECURE Act, all non-designated, non-eligible beneficiaries are required to empty the account after 10 years.

Should you be contributing to a Roth IRA?

When deciding between a traditional and a Roth IRA, one major determining factor is the difference between your current tax bracket and your expected tax bracket in retirement. Simply put, you want to pay the tax when you are in the lowest tax bracket.

If you are just starting out in your career with a relatively low salary, it may be best to contribute after-tax dollars to a Roth IRA. Conversely, if you are nearing retirement and are in the highest-paying years of your career, it may be best to contribute pre-tax dollars to a traditional IRA – if the income deduction limits allow.

Another factor to consider is time. How much time will the funds have to be invested? For contributions to Roth IRAs, the net amount you contribute is less than the amount you would contribute to a traditional IRA. Why? The contribution is post-tax, and rather than compounding those tax dollars within your retirement account (traditional IRA), a portion of those dollars are sent to Uncle Sam at the beginning, instead (Roth IRA).

While it “costs” more to contribute to a Roth account, the more years that your post-tax funds can grow, the more likely that the value attributed to the tax-free growth will outweigh the immediate tax deduction.

If you are still having trouble choosing, evaluate your spending habits. Are you more prone to spend the tax savings you receive from contributing to a traditional IRA? If so, consider contributing to a Roth IRA to ensure those dollars are used for future savings. Or hedge your bets and contribute to both a traditional and a Roth IRA. This may relieve the stress from guessing future tax rates by simply paying half of the tax now and the other half later.

Summary

The table below provides a summary of the major similarities and differences between traditional and Roth IRAs. The most important thing to do is to contribute to your retirement account(s) – no matter the account type or the amount. Take advantage of the early years, be consistent, and speak with a financial advisor to discuss your specific situation, if needed.

Tull Financial Can Help

If you have questions about IRAs or any other retirement investment vehicle, please feel free to contact Tull Financial Group on 757.436.1122. Our advisors can assist with this and retirement planning so that you can feel confident about where you are placing your hard earned money.