How to Navigate Unknown Unknowns – Stock Market Volatility

by Robert W. Tull | December 17, 2021 | Financial Planning, Investment Planning

Will we ever one day become accustomed to stock market volatility?

I often ask myself this question, especially following the prolonged rise in equity markets experienced over the past 18 months. The good news is that based on history, it will be only a matter of time before a market correction occurs.

With that said, and knowing that stock market volatility will always be with us, the question remains: can we ever become comfortable with it? Before we answer that question, we need to understand the primary cause of this volatility which is uncertainty.

I am often reminded of the now famous quote by President George W. Bush’s secretary of defense:

As we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know.

It sounded very confusing to the reporters listening to Donald Rumsfeld’s press conference in 2002 and it still does to many today, but here’s my attempt to summarize his point: no matter how much information we have, there will still be some uncertainty.

An excellent book on this subject is Thinking in Bets by Annie Duke. Although I don’t compare investing in the stock market to playing poker, stay with me for the principle this Wall Street Journal bestselling author shares: “What makes a decision great is not that it has a great outcome.

A great decision is the result of a great process, and that process must include an attempt to accurately represent our own state of knowledge. The state of knowledge, in turn, is some variation of ‘I’m not sure.’”

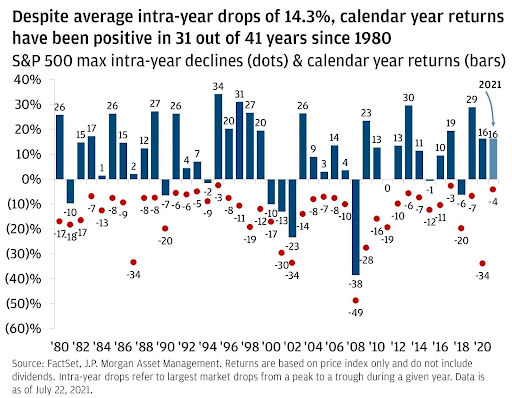

Let’s face it, we do not and cannot know the future. Market volatility is unsettling for everyone, but historically not unusual. Since 1980, the S&P 500 has experienced an intra-year average maximum drawdown of -14%. Yet the index has posted positive calendar year returns more than 75% of the time, which tells us that staying in the market and long-term investing has paid off.

Of course, past performance isn’t always indicative of future results, but we expect the stock market to digest and weather volatility as it occurs. Based on this historical knowledge we know that risk is required in order for our assets to grow. And over time, risk has generally been rewarded with positive and active investment returns.

Near the beginning of the pandemic in May 2020, renowned investor Howard Marks wrote, “True expertise is scarce and limited in scope, expertise and predictable ability are two different things, and we should be careful about who we listen to and how much weight we give to their pronouncements.”

It is a fact of life that uncertainty will remain with us. Because of this, we must make decisions about the future without knowing it. Therefore, what steps can we take to limit the downside risk while actively participating in positive performance over time? As we often share, building an appropriately diversified portfolio that matches your time horizon and risk tolerance is the first place to begin.

Along with that, consider a few additional investing principles:

- Establish a financial plan. Volatility is a lot easier to stomach when you have a financial plan in place based on your goals and investing timeline. When you keep your eyes on the finish line, you’re less likely to panic and sell when prices are down.

- Don’t try to time the markets. It’s nearly impossible. Time in the market is what matters. While sticking with it and staying invested even when markets dip may be nerve wracking, it can result in a healthier portfolio and greater accumulated wealth over time.

- Build a diversified portfolio based on your personal tolerance for risk. It’s important to know your comfort level or as I often say, your sleep level, with temporary losses. Sometimes a market drop serves as a wake-up call that you may not be as comfortable with losses as you thought you were, or that a portfolio you assumed was appropriately diversified in fact isn’t. Use cash investments and bonds for diversification.

- Regularly reevaluate and balance your portfolio to keep it aligned with your risk tolerance. Meet with a Certified Financial Planner Professional and perform a risk analysis. Together you can quickly assess whether your portfolio is still in balance with your target asset allocation.

- Finally, IGNORE the noise. This is a principle that sounds simple but one I still personally work on daily. News reports make noise and sell advertising. Markets will fluctuate, so stay focused on your long-term plan. Remain calm even when markets are not.

Realistically, as long as there is uncertainty, there will be volatility. With that said, the recovery phase of the business cycle is maturing. Corporate earnings are good, consumers are showing more confidence, and the Federal Reserve will continue to keep a close eye on incoming data before making its next move. These are things we know we know. What happen next week is something we know we don’t know.

If you’re concerned about your portfolio’s risk level, or have any other questions about market investments, we’d be happy to talk to you. Contact Tull Financial Group @ 7574361122 today.