Charles Schwab prides itself as a custodian that puts its clients first. One facet of their commitment to customer service is their user-friendly, clientele-only website, Schwab Alliance. Schwab Alliance is exclusive to clients of advisors and the website offers many features that simplify settings and updates. Below will cover four basic requests a client may need along with brief instructions.

Statements and Tax Forms

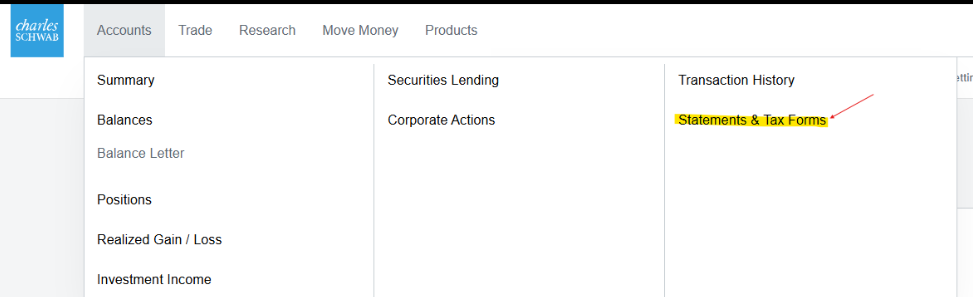

You may need to download statements and/or tax documents from Charles Schwab for a variety of reasons, including but not limited to: tax filing (Form 1099), personal financial recordkeeping, legal purposes, loan applications, etc. Schwab Alliance makes it simple for clients to download these documents, as needed:

1. Once you have logged in to your Charles Schwab account, hover over the “Accounts” tab and select “Statements & Tax Forms.”

2. Once directed to this page, you will see the “1099 Dashboard,” which houses your tax document(s) as they are made available by Charles Schwab. You will also see the “Statement and Documents” section, which allows you to choose a date range as well as the types of documents you may need.

Change of Address/Contact Information

Before logging onto Schwab Alliance to change your address, be sure you have set up a forward mail request with USPS. Schwab will mail a letter to both your current and old address notifying you of the change and you wouldn’t want the new resident to receive this change!

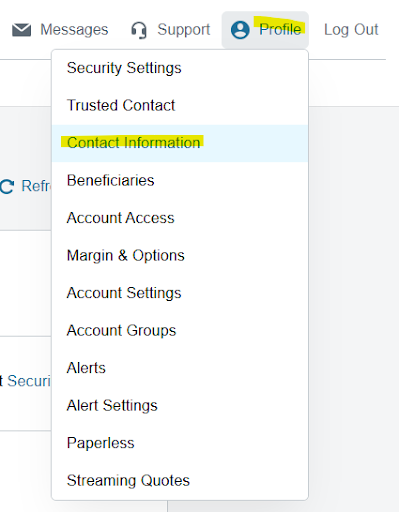

To update your contact information, log into Schwab Alliance and click on the “Profile” icon in the upper right side of the menu bar. Select “Contact Information” from the dropdown menu.

Here you may also update your primary email address and phone number. If you have a joint account, you may update the same information for your joint tenant as well. Once your changes have been made, click the green “Save” button.

Communication Settings

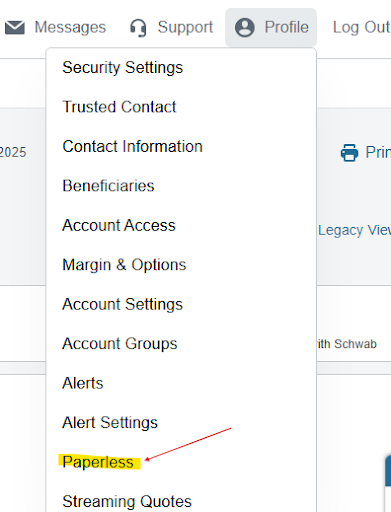

Tired of receiving Schwab statements, trade confirmations and proxy voting mailers to your home address? You can switch your communication settings to paperless using Schwab Alliance. After logging in to Schwab Alliance, click on the “Profile” icon in the upper right corner of the menu bar and select “Paperless” from the dropdown menu.

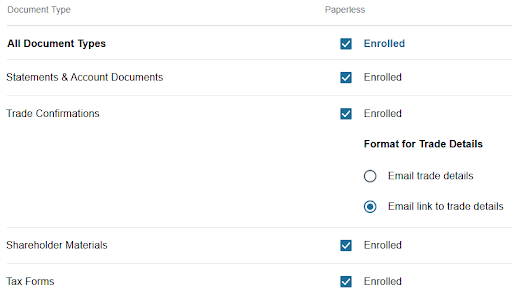

You will then see every account you have listed and the ability to either enroll in or disenroll (uncheck the box) from Charles Schwab’s paperless communication.

Beneficiary Updates

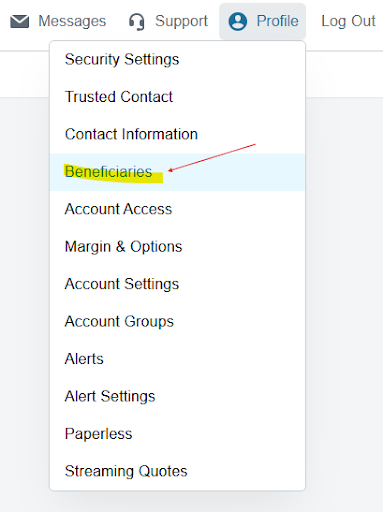

Are your beneficiaries up to date? Using Schwab Alliance, you can complete beneficiary updates as often as needed, and we recommend that you review them at least once a year.

Once in Schwab Alliance, you will see the “Beneficiaries” option under the “Profile” icon. Once you click on it, you will see each of your investment accounts listed and can then follow through with reviewing and/or updating beneficiaries for each account.

It’s important for beneficiaries to be reviewed and updated as necessary to ensure your assets are distributed as you intended upon our death; generally, beneficiaries take priority over a will or trust. Designating beneficiaries also helps to avoid probate, a costly and time-consuming process. Remember, not all accounts are eligible for naming beneficiaries – eligible accounts include Schwab One Designated Beneficiary Plan, Schwab Bank High-Yield Investor Checking, and IRAs.

Finally, Schwab Alliance operates a customer service center for clients that utilize a Registered Investment Advisor like Tull Financial Group. Please keep this number handy for any issues with the Schwab Alliance website: (800) 515-2157. Of course, don’t hesitate to reach out to us here at TFG. We are just a phone call away at 757-436-1122.